can malaysian open bank account in singapore

Singapore offers a number of great features with its debit cards including cashback and discounts. And have an account with HSBC consider opening an account with a Singapore branch so you can easily transfer your money.

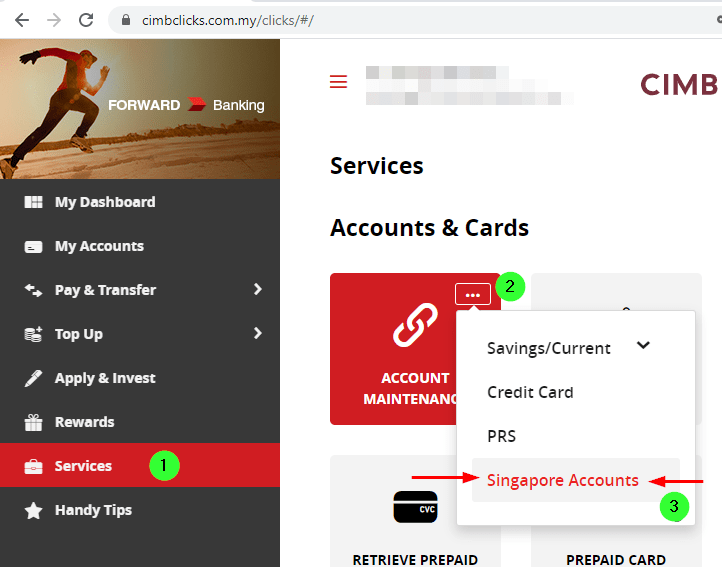

How To Open A Cimb Singapore Account From Malaysia Step By Step Guide Youtube

DBS OCBC or UOB.

. A Malaysian Identity Cardholder in Singapore can apply for a bank account with the same documents as a local resident except instead of a Singapore ID card there will be a need to see their Malaysian ID. Malaysian customers will be able to open Singapore bank accountsCIMB Bank Berhad and CIMB Islamic Bank Berhad CIMB launched their Cross-Border Solutions for their customers with CIMB accounts in Malaysia and SingaporeAccording to a press release CIMBs Cross-Border Solutions cater to any customer living in Malaysia or Singapore. Answer 1 of 7.

As a local Malaysian we have an identity card or known as MyKadThis MyKad is a compulsory identity card with a unique 12-digit number issued to Malaysian citizens and Permanent Resident PR. There are plenty of options to choose from and a wide range of banking services are made available even in the smallest of banks. A MyKad is normally used for any official business made by the citizen and opening a bank account is one of it.

The easiest way is using your employment or study pass. For Branch Account Application each applicant will need to bring along the original copy of the required documents. Banks can also charge you fall-below fees if you dont keep your account above a certain amount.

There is no exception for Malaysian. For example if youre from the the UK. It is strongly recommended to open Singapore Account with your Malaysian NRIC to ease the linking process between Malaysia Singapore with the same NRIC Number.

Tax submission to LHDN ensure that you declare it under the CRS Reporting. Many Singaporeans trade in Malaysia stock market and. You can do these at our branches or using online banking.

Each bank has its own process for opening accounts so the exact documents required may vary slightly depending on the bank you select. But there is a chance that you can do it without one if youre able to provide enough information that the bank needs. With their CIMB conventional or Islamic.

Singapore is home to a large expat community so its banks and financial services are used to dealing with foreigners. In most cases you can expect to be asked for the following¹. Need some adviceAlso is it possible to open a bank account through online without physically having to go to singapore.

Open a Wise Multi-Currency Account which gives you Singaporean bank details through DBS Bank among others as well as a debit card to spend in multiple currencies including Singaporean dollarsYou can even open an online account before arriving in Singapore although youll need to verify your address before receiving your debit card. Go to any Malaysia bank and tell them you want to open a bank account. A Malaysian bank account can now be opened in Singapore.

In other words you can save on the expensive FX and intermediary banking fees by funding your broker via a Singapore bank account. If a Malaysian wishes to open any bank. Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation for up to S75000 in aggregate per depositor per Scheme member by law.

It is the same processing for opening bank accounts in Singapore for Malaysians and foreigners. How to use your Singapore bank account to fund your foreign stock brokeraccounts. CIMB Clicks will also waive fee for fund transfers between CIMB accounts and CIMB ATMdebit cards will waive fee for withdrawing funds.

Open a bank account online in Singapore without an Employment Pass. The document requirements are the same for non-resident business owners and investors in creating the bank account in Singapore whether the non-residents are Malaysians or not. At the level of 2021 some of these fees have been.

One major benefit of having a Singapore bank account is many foreign brokers accept the SGD currency compared to MYR. It is possible in Malaysia to open a CIMB Singapore account. If you are a tax resident ie.

Hi guys was wondering if a malaysian whos not working in singapore and with no PR able to open a singapore bank account. Necessary documents to open a bank account in Singapore as a foreigner. Malay-Singaporean relations mean that Malaysian citizens in Singapore can enjoy certain avenues to residential perks including bank accounts.

An overseas residential address can used to apply for an account if a Singapore address is unavailable at that point. As you can see opening a bank account in Malaysia as an expatriate or foreigner is an easy process. Yes you can open a bank account online with a Malaysian bank BUT theres a prerequisite.

You usually will need an employment pass from your employer in Singapore in order to open a bank account. A non-commercial address where the customer resides. Foreign currency deposits dual currency investments structured deposits and other investment products are not insured.

Most of the banks in Singapore offer attractive features such as multi-currency accounts internet banking credit cards trade financing freedom to move funds across countries and more. This can be difficult. Opening a corporate bank account in Singapore is a relatively simple and straight-forward.

You can open a HSBC Everyday Global Account HSBC Premier Account or Singapore Dollar Savings Account. Has anyone done it. The first option is to open an account with a bank you already have a relationship with.

To open a bank account you will generally need to make a deposit to confirm the account. Banks in Singapore have specific requirements for opening bank accounts and charge different fees. Important information Residential Address.

Malaysian banks like CIMB and Maybank offer limited products that can be set up online without the need to personally go to the branch. Prepare also your proof of IC residential address and e-signature ready with you. Proof of identity such as a valid passport or national ID card.

The next best option is one of the big three banks in Singapore. The banking world in Malaysia is essentially your oyster so to speak. How to open a bank account in Singapore as a non-resident.

Customers in Singapore and Malaysia will have access to a relationship manager to assist them with their wealth management needs. If you are a Singaporean you can open a bank account in Malaysia. Singapore companies have plenty of options when it comes to opening a corporate bank account.

Clients will usually receive a card with a PIN that can be used for online banking operations. I read online that for POSB its quite straighforward to open an account. This means that it should be relatively straightforward to open a bank account in Singapore as a non-resident.

You would need a Singapore Identity card or passport together with your Malaysia Ringgits. Please note that you cant use the digital account opening journey to open an investment account or apply for a credit card or cheque book.

Financial Management Solutions Fortune My Stock Trading Investing Financial Management

Malaysia Public Bank Statement Template In Word Format Statement Template Bank Statement Templates

Should I Open A Subsidiary Or A Branch In Malaysia In 2021 Malaysia Branch Starting A Business

How To Open Cimb Singapore Account For Malaysian Ringgit Freedom

The Old Blue Passport That Could Only Be Used To Access To West Malaysia Thanks黄龙强 For The Photo Submission Sgmemory Singapore Navy Singapore Memories

Which Online Lottery Can I Play From Malaysia Online Lottery Lottery Winning Lottery Numbers

Malaysian Bank Rolls Out Contactless Card Acceptance On Standard Nfc Phones Whatsnewinpayments Google Nfc Bank Acceptance

Best Banks For American Expats Philippine Peso Mexican Peso Argentine Peso