inheritance tax changes 2021 uk

Inheritance Tax Changes in 2022. In addition to this there exists the residence nil rate band which is currently 150000 per person soon to be 175000 for the 20202021 tax year.

What Is Inheritance Tax Nerdwallet Uk

The All-Party Parliamentary Group for Inheritance Intergenerational Fairness APPG suggested changes to IHT in January 2020.

. He told Expresscouk. These included aligning rates of CGT to income tax levels and cutting the annual gains allowance from 12300 to as little as 2000 per person but with fewer assets attracting the charge. The person died on January 2 2022 leaving an estate worth 285000 which is below the inheritance tax threshold.

National Insurance threshold and rate changes. Individuals have 120000 additional gift and generation-skipping transfer tax exemptions that can be used this year. Annual exclusion gifts individuals can make certain gifts up to 15000.

Often referred to colloquially as death tax it is a levy that is placed on estates that are worth more than the IHT threshold. Rates reliefs and responsibility. For married couples they benefit from a cumulative NRB of 650000 2 x 325000.

Initially this was set at 100000 but rises to 175000 in. The rate of tax you pay at each bracket also remains the same. This will just be taken along with the rest of your.

15 October 2021 1423. Here is a breakdown of the income tax brackets on earnings for 2022. National Insurance rates are set to rise by 125 percentage points from 6 April 2022 as part of the governments plan to introduce a health and social care levy where working people contribute to fund the NHS and the social care crisis.

For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. In April 2017 the Government introduced an additional nil-rate band when a residence is passed on death to a direct descendant. The Government has previously announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20212022.

The rate remains at 40. Reducing the IHT tax rate of 40 to a rate of 10 for estates up to 2m 20 for estates over 2m. Tax Day on 23 March 2021 announced that the excepted estates rules would be changed.

For lifetime gifts there would be no capital gains tax on the gift. For exempt estates the value limit in relation to the gross. The tax body stated.

Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. 0 to 12570 Tax-free. On the 1 January 2022 The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021 came in to force significantly changing the requirements for many Personal Representatives when administering smaller non-taxpaying estates.

07 January 2021. ICAEW technical editor Lindsey Wicks looks at the effects as more than 90 of non-taxpaying estates will no longer have to complete full inheritance tax accounts. 50271 to 150000 Higher rate taxed at 40.

The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021. In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported. On death it has been suggested that there will be no tax free uplift the donee inherits at the donors base cost.

Currently each person has a nil rate band NRB of 325000 up to which there is a 0 charge to IHT. Under the EU Succession Regulation the law of the place of residence on death is presumed to govern inheritance so if France is the deceaseds place of residence French law will apply to hisher world-wide estate as the effect of the new law will be to disregard the deceaseds possible choice of hisher national law made by will. UK Inheritance Tax Reform.

Reducing the annual allowance would mean more people. Changes to the excepted estate rules announced this year will apply from January 1 2022. In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported when applying for a probate.

The OTS review of CGT published in September suggested four key changes as part of an overhaul. Gifts and generation skipping transfer tax exemption amounts are indexed for inflation increasing to 117 million in 2021 from 1158 million in 2020. Only six states actually impose this tax.

Reducing the IHT tax rate of 40 to a rate of 10 for estates up to 2m 20 for estates over 2m. This led to predictions of reform in March when Rishi Sunak delivered his first Budget as Chancellor. The main residence nil rate band MRNRB has increased from 150000 to 175000 therefore potentially saving.

Such suggestions are a long way from becoming law and any changes to IHT of such a fundamental nature would need to be very carefully thought through and consulted upon by the government but the nature of the two reports might be seen to be an indication. Instead the donee will take over the base costs of the donor. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other.

If the person died on or before 31 December 2021 no IHT205 form needs to be completed if it is an excepted estate or they do not need a probate. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. 12571 to 50270 Basic rate income tax of 20.

The limit for chargeable trust property is increased from 150000 to 250000. This is called entrepreneurs relief. In March 2021 the government announced changes in IHT which will become effective from January 2022.

In 2021 Iowa passed a bill to begin phasing out its state inheritance tax eliminating. 150000 Taxed at 45.

Why Should We Care About Inheritance Tax The Independent

Inheritance Tax Advice For Expats And Non Uk Residents Experts For Expats

How Can I Reduce My Inheritance Tax Bill Times Money Mentor

Inheritance Tax Debate What The Wealthy Need To Know

How To Avoid Paying 975 000 Inheritance Tax With This Little Known Trick In 2022

Inheritance Tax Planning May 2022 Uk Guide

Will Uk Inheritance Tax Increase Because Of Covid 19 Stellar Am

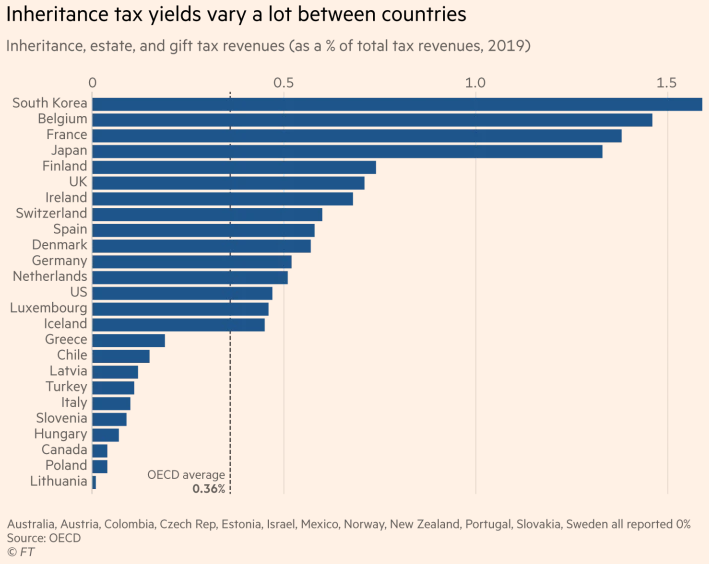

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Inheritance Tax Receipts Uk 2022 Statista

401 K Inheritance Tax Rules Estate Planning

Life Insurance And Inheritance Tax Forbes Advisor Uk

How Much Inheritance Tax Will I Pay In 2022 And How Can I Reduce Or Avoid It

9 Ways To Pay Less Inheritance Tax Financial Advisor Bristol

South Carolina Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Receipts Uk 2022 Statista

9 Ways To Pay Less Inheritance Tax Financial Advisor Bristol

How To Avoid Inheritance Tax In The Uk 7 Legal Loopholes To Cut The Cost In 2022

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips