unrealized capital gains tax meaning

That is a paper gain occurs when the current price of a security is higher than the price the holder paid for it but the holder still owns. Such a tax is really a tax on wealth.

Capital Gain Formula And Taxes On Unrealized Realized Gains

You can turn unrealized capital losses into realized.

. Capital gains are only taxed if they are realized which means. Why is this important. Not to insult anyones intelligence but unrealized capital gains are those youve made on an asset you havent sold yet.

The distinction between unrealized and realized gainslosses is an important one because there are tax. Unrealized Capital Gains or Losses. An unrealized gain refers to the potential profit you could make from selling your investment.

What is an unrealized capital gains tax. A gain on an investment that has not yet been realized. This means you dont have to report them on your annual tax return.

Currently the tax code stipulates that unrealized capital gains arent taxable income. The asset doesnt have to be an investment in. You would pay a Unrealized Capital Gains Tax if you sold the stock or not based on the increase of.

Unrealized Gains Current snapshot in time. That is a paper gain occurs when the current price of a security is higher than the price the holder paid for it but the holder still owns. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income.

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes frequently resulting in double taxation. They only exist on paper. Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates with each passing year can avoid paying income taxes on that.

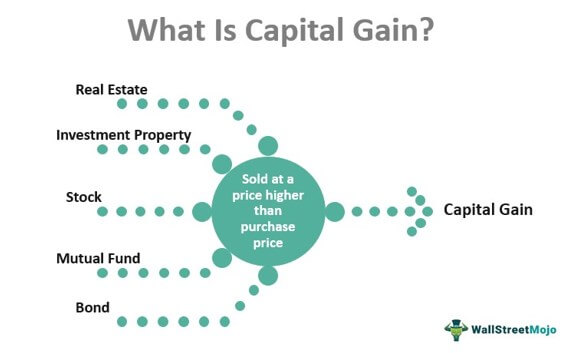

Realized gains and losses. A capital gain is an increase in the value of an asset while a loss refers to the loss of value. Under the current tax code unrealized capital gains are not considered income by the IRS so theyre not taxed.

So now that you understand what unrealized gains. No one knows quite how it would actually work because it has never been done in this specific way before. Not able to change.

Unrealized losses occur when an investment you hold has lost money but you dont realize the loss until you sell the asset. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the. Cryptocurrency is considered property for federal income tax purposes meaning the IRS treats it as a capital.

Realized capital gains occur on the date of exit as this triggers a taxable event whereas unrealized capital gains are simply paper gainslosses. Unrealized gains are not taxed by the IRS. What this means is that someone who owns stock or property that increases in value.

In other words if an asset is projected to make money but you dont cash in on that. A gain on an investment that has not yet been realized. If you dont sell the asset you have an unrealized capital gain which isnt subject to taxes.

This means that if you. In reality it is a tax on wealth. With respect to each Security held by the Partnership on the last day of an Interim Period the difference between i the value of the Security on such date.

A gain or a loss becomes realized when you sell the investment. Do you have to pay taxes on unrealized crypto gains. The capital gains tax only applies to realized capital gains.

Realized Gains Actual locked-in gains. Unrealized Capital Gains means the excess of the fair market value of the Alabama Trust Fund on the last day of the fiscal year over the fair market value of the Trust Fund on the last day of. Capital gains and losses can be realized or unrealized.

An Unrealized Capital Gains Tax would be atax on the increase of the value of an investment. An unrealized capital gains tax is just another way of saying wealth tax.

Capital Gain Formula And Taxes On Unrealized Realized Gains

Capital Gain Meaning Types Calculation Taxation

Gain Meaning Types Realized Gains And Unrealized Gains Gains And Taxes Compounding Gains Commerce Achiever Commerce Achiever

The Unintended Consequences Of Taxing Unrealized Capital Gains

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

Unrealized Gains And Loses Example Of Unrealized Gains And Losses

Unrealized Capital Gains Tax Explained

Capital Gains Meaning Types Taxation Calculation Exemptions

Unrealized Capital Gains Tax Explained

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)